-

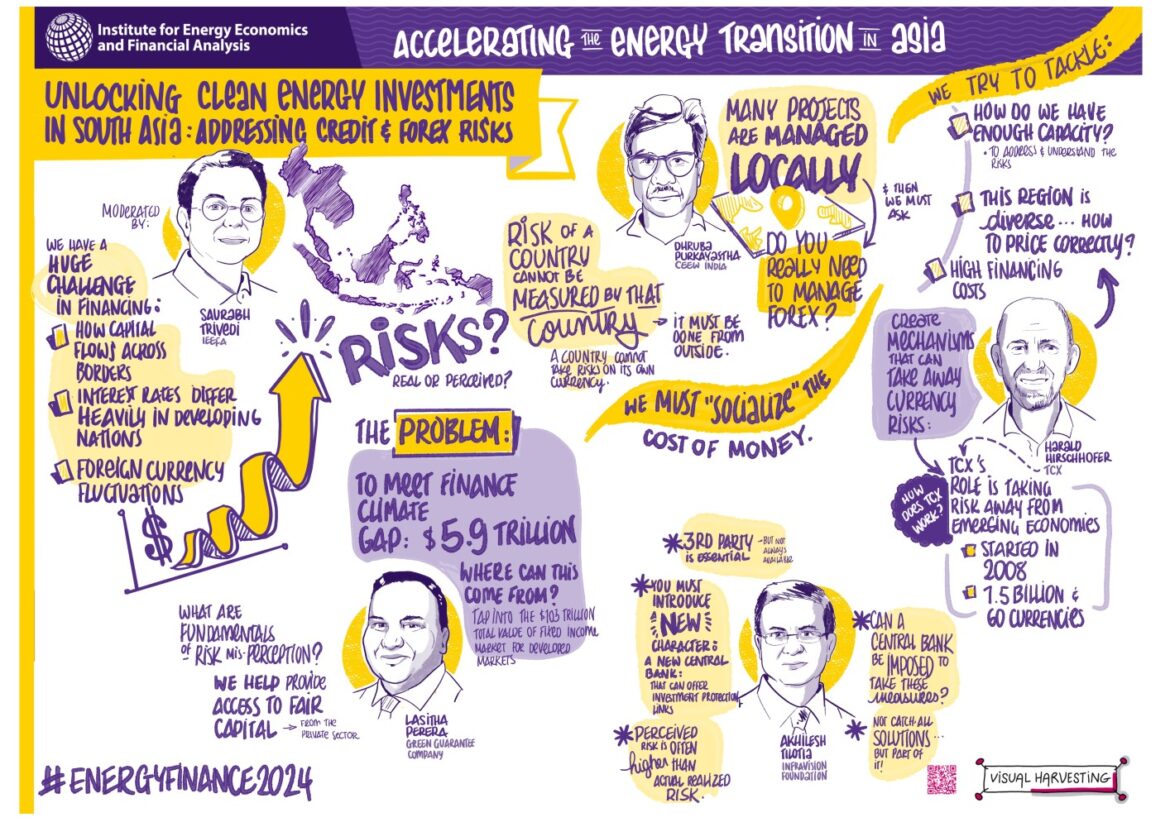

Unlocking Clean Energy Investments in South Asia: Addressing Credit and Forex Risk

By: IEEFA Energy Finance Conference, 2025 Institute for Energy Economics and Financial Analysis (IEEFA) had a three-day IEEFA Energy Finance Conference at Kuala Lumpur last week bringing experts from around the world to focus on effective solutions in Asian energy markets. I moderated the panel discussion on credit and forex risks with Lasitha Perera, Akhilesh […]

-

RBI’s options for tackling climate change-induced inflation

The opinion piece, first published in The Hindu BusinessLine, examines how climate change is emerging as a significant threat to price stability and financial resilience in India, with the RBI’s April 2024 report highlighting its potential to raise headline inflation by about 100 basis points and decrease long-term economic output by 9% by 2050 without […]

-

Empirical Essays on Carbon Risk Management, Bond Short Selling and their Respective Impact on CDS Spread

This dissertation empirically examines two novel research issues: firm-level carbon risk management and corporate bond short selling. The first essay (Chapter 2) develops a firm-level carbon risk management score (CRMS) to evaluate corporate practices around carbon risk mitigation. The indicators for CRMS are extracted from a wider set of environmental risk management indicators and capture […]

-

The Role of Coal in a Sustainable Energy Mix for India

Chapter: Decarbonisation Goals: Benchmarking NTPC and Tata Power with Enel and Recommending a Sustainability-Linked Finance Framework The case-study analyzes the decarbonization strategies of India’s major power companies, NTPC and Tata Power, in the context of India’s 2070 net-zero emissions target, which requires an estimated US$10.1 trillion investment (with US$8.4 trillion needed for the energy sector […]

-

Enhancing Access to Multilateral Climate Funds by Developing Countries: A Way Forward

The paper, admitted as an official input paper for the G20 Sustainable Finance Working Group during the Brazilian Presidency, examines how to enhance developing countries’ access to multilateral climate funds (MCFs). It analyzes the current global public climate finance architecture, noting that while public climate finance nearly doubled from 2013-2021 to US$73.1 billion, accessing these […]

-

Energising Australia’s green bank

The report examines Australia’s need for massive private investment to achieve its net-zero emissions target by 2050, requiring an estimated AUD1.5 trillion by 2030 and potentially AUD7-9 trillion by 2060. It analyzes the Clean Energy Finance Corporation (CEFC), Australia’s green bank with a AUD30.5 billion capital base, which achieved an impressive private capital mobilization rate […]

-

Powering India’s Future: Towards a People-Positive Energy Transition

Chapter: The Central Bank’s Role in Energy Transition The chapter discusses the evolving role of central banks, particularly the Reserve Bank of India (RBI), in addressing climate change risks and supporting energy transition. It explains how central banks are developing frameworks to manage three types of climate risks: transition, physical, and liability risks, with 127 […]

-

Policy Recommendations and Discussion on Energy System Transition and Energy Security in the Context of Climate Change Adaptation – What is our Challenges and Opportunities

By: 2023 APEC Climate Symposium & Asia Pacific Climate Services, Joint Conference Web Link APCC Climate Center APEC Climate Symposium

-

Billions in oil and gas investments undermine Macquarie Group’s climate commitment

The report examines how Macquarie Group’s nearly A$5 billion investments in oil and gas companies contradict its commitment to net zero emissions by 2050 and the 1.5°C global warming goal. Despite being a Net Zero Banking Alliance (NZBA) signatory since October 2021, Macquarie has made significant investments in companies with aggressive expansion plans, including a […]

-

Unlocking sustainable investments: The Reserve Bank of India’s crucial role in energy transition

An abridged version of this article, first published in The Hindu BusinessLine, examines the Reserve Bank of India’s crucial role in enabling India’s energy transition, which requires approximately US$10 trillion in investments to achieve net-zero targets by 2070. Drawing from global central bank experiences, it analyzes RBI’s recent report proposing measures like lowering borrowing costs […]