-

Strengthening India’s carbon market: The case for a stability mechanism in India’s CCTS

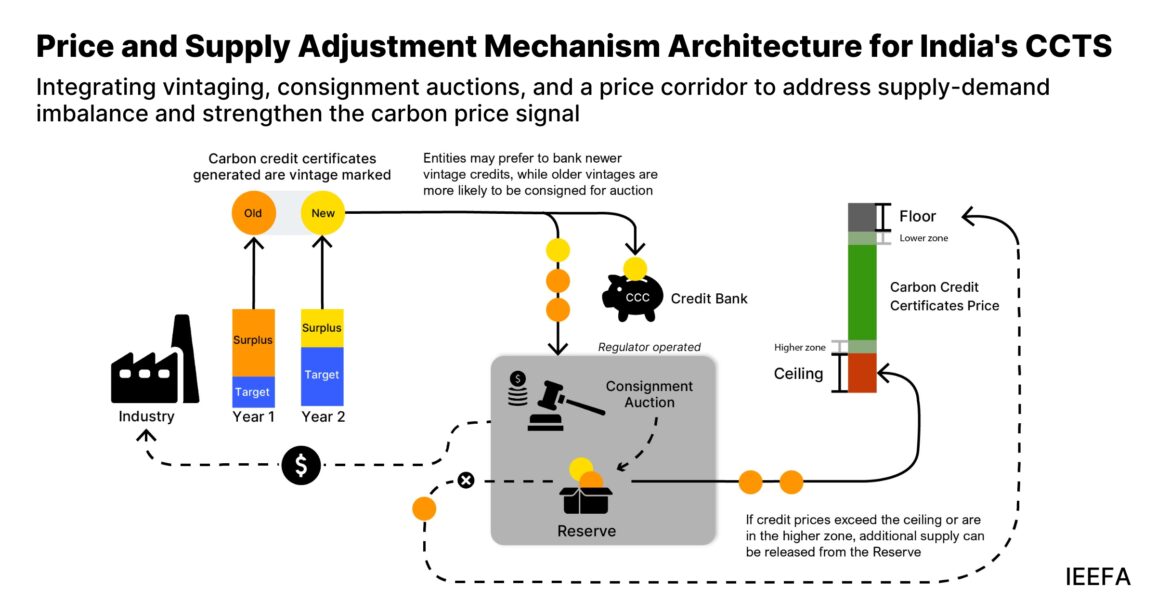

India’s upcoming Carbon Credit Trading Scheme (CCTS) is designed to reward facilities that beat emissions intensity targets while allowing emissions to grow alongside the economy, but this flexibility also creates a risk of early oversupply of credits and weak carbon prices. Past experience from India’s Perform, Achieve and Trade (PAT) scheme and international markets such […]

-

Battery Subscription Facility

The Battery Subscription Facility is a conceptual financial instrument designed to address key barriers to electric bus adoption in India. The proposed mechanism would reduce upfront costs by 40-50% through a battery-as-a-service model, where the Facility would own batteries while bus operators subscribe to their use on a daily or per-kilometer basis. If implemented, this […]

-

FX Hedging Facility

The FX Hedging Facility is a customizable currency hedging product comprised of a foreign exchange (FX) hedging facility backed by an FX tail risk guarantee. The mechanism targets a particular tranche of FX risk and allows allocation of risks to suitable parties, and also eliminates the credit risk premium otherwise charged in a commercial currency […]