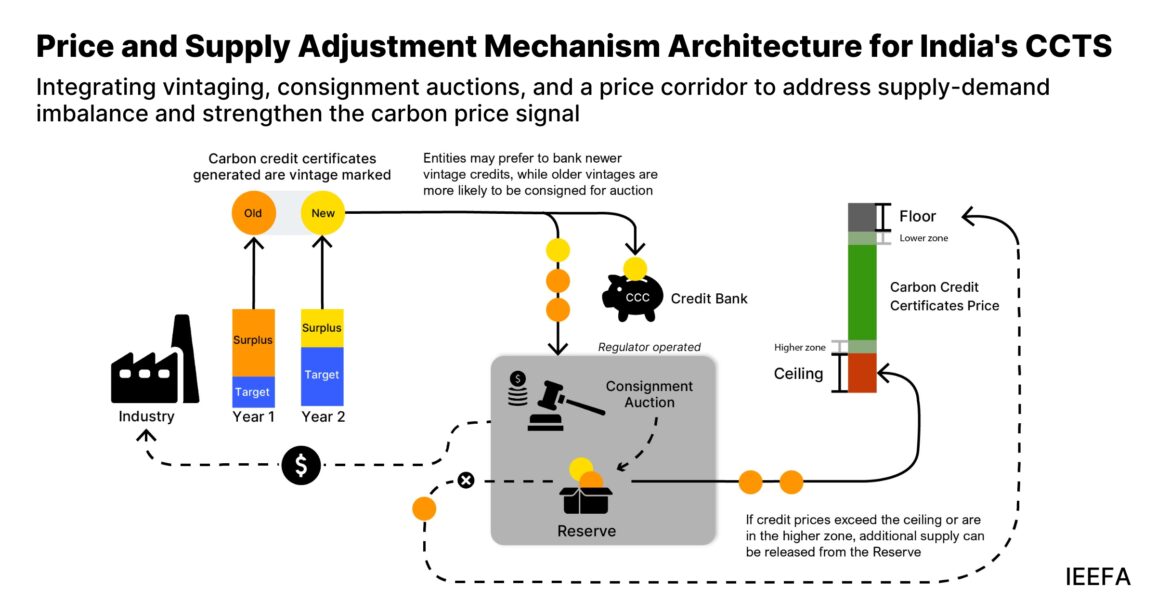

India’s upcoming Carbon Credit Trading Scheme (CCTS) is designed to reward facilities that beat emissions intensity targets while allowing emissions to grow alongside the economy, but this flexibility also creates a risk of early oversupply of credits and weak carbon prices. Past experience from India’s Perform, Achieve and Trade (PAT) scheme and international markets such as the EU ETS, Alberta, Australia and California shows that if you do not control surplus early, prices can collapse, investment signals weaken, and later reforms become politically difficult and more disruptive. To avoid that, India should embed a Price or Supply Adjustment Mechanism (PSAM) from the start: a transparent, rules-based way to adjust credit supply when prices are too low or too high, without relying on ad hoc interventions. The proposed PSAM for CCTS would work through three tools suited to India’s current institutions: consignment auctions (to enable orderly intervention in supply while preserving firms’ rights over their credits), vintage-based credit rules (to limit the long-term buildup of old surplus without confiscating it), and a price corridor (to trigger supply tightening when prices crash and easing when prices spike). Introducing these mechanisms early would help maintain credible, investable carbon prices, build predictability for industry, and reduce the likelihood of future market shocks. In doing so, India can position the CCTS not just as a compliance tool, but as a durable industrial policy instrument that supports both competitiveness and decarbonisation.

Key Citations

India must embed stability tools in the carbon market to avoid costly reforms, say experts

Leave a Reply