Research Work

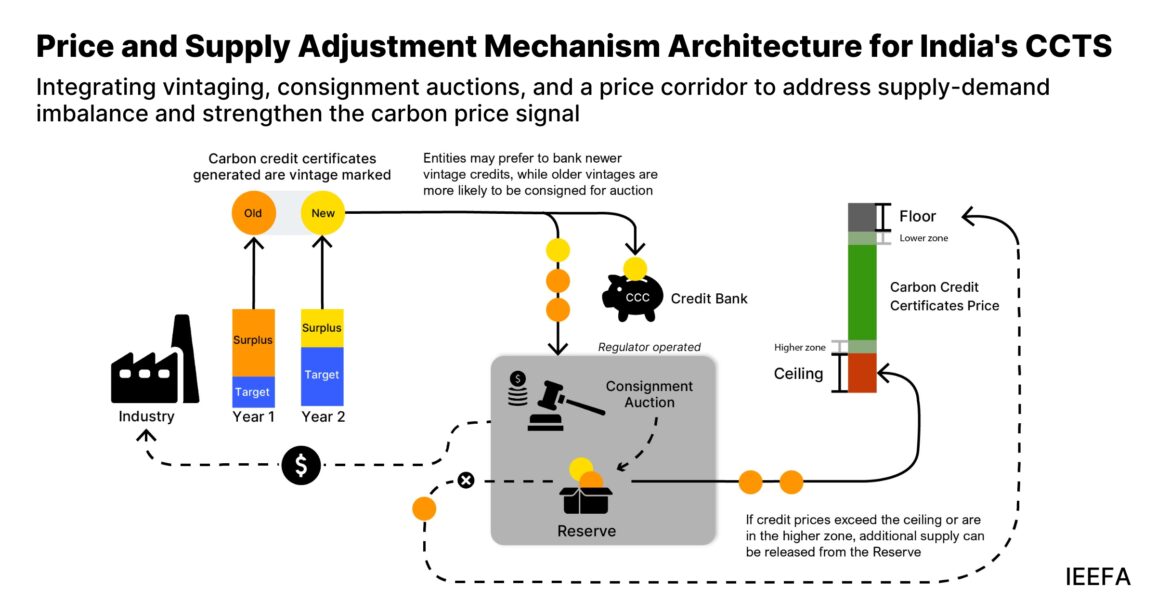

My research focuses on climate finance, sustainable investment strategies, and economic policy. By leveraging data-driven insights and financial modeling, I aim to contribute to the development of innovative financial solutions for a more sustainable future.